In 2021, the Washington Legislature passed the Climate Commitment Act (CCA), which establishes a comprehensive, market-based program to reduce carbon pollution and achieve the greenhouse gas limits set in state law. The program started Jan. 1, 2023, and the first emissions allowance auction was held Feb. 28 the same year.

Businesses covered by the program must obtain allowances equal to their emissions and submit them to Ecology according to a staggered four-year compliance schedule. The first compliance deadline is Nov. 1, 2024, at which time businesses need to have allowances to cover just 30% of their 2023 emissions.

In 2021, the Washington Legislature adopted a historic package of legislative and budget proposals to combat climate change and prepare the state for the future low-carbon economy. The Legislature provided Ecology with the authority and funding to develop rules and requirements to implement three major climate bills: Climate Commitment Act, the Clean Fuel Standard, and an expanded hydrofluorocarbons management program.

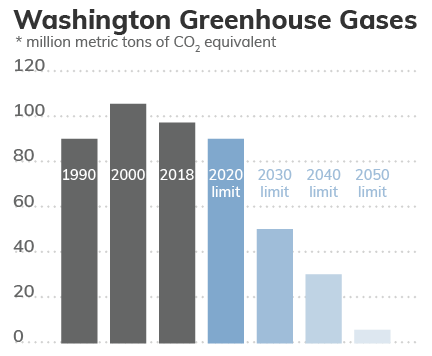

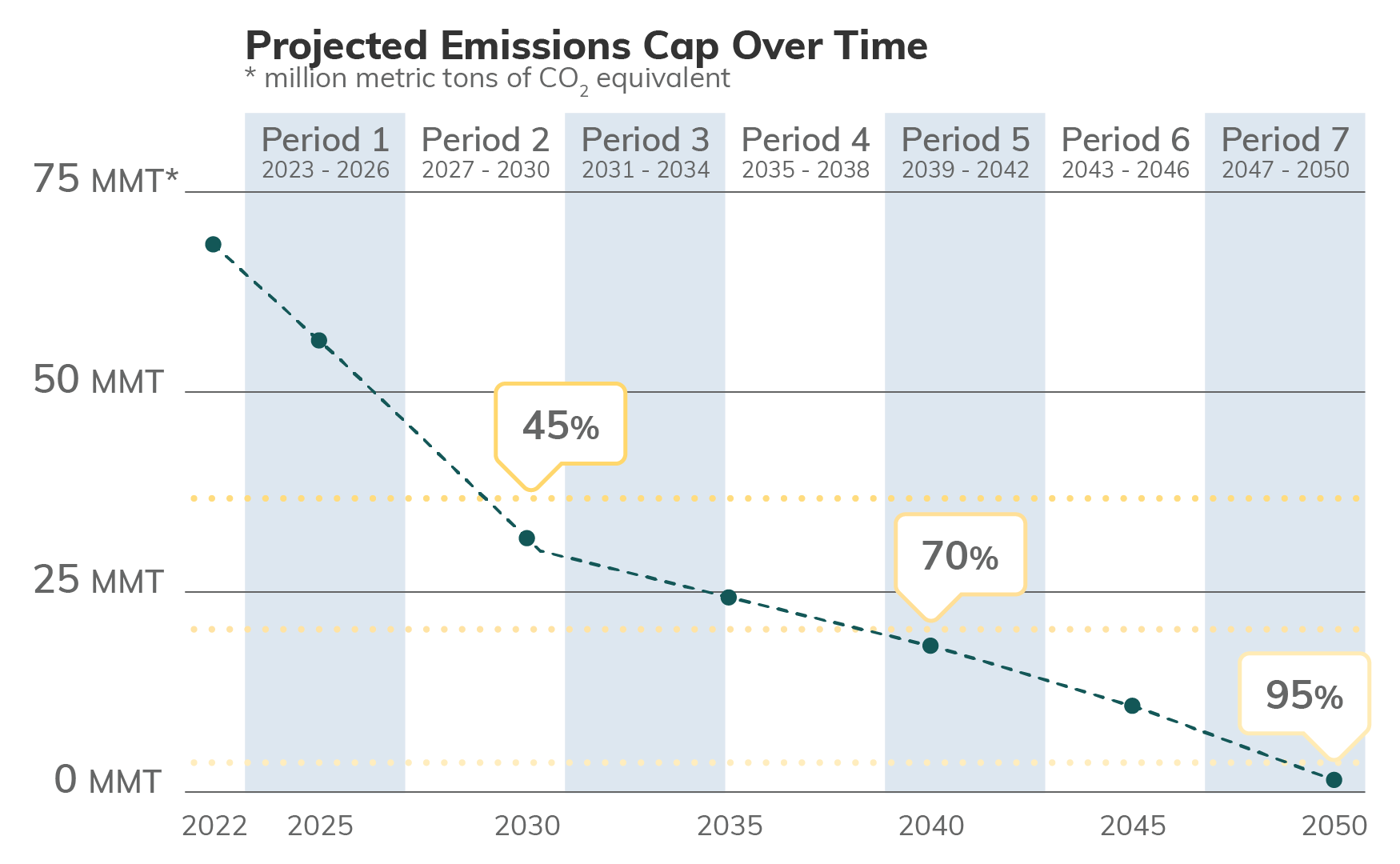

Together with existing policies advancing clean energy and zero-emission vehicles, these new laws put Washington on a path toward achieving the greenhouse gas limits set in state law: 45% below 1990 levels by 2030, 70% below 1990 levels by 2040, and 95% below 1990 levels and net-zero carbon emissions by 2050.

The cap-and-invest program sets a limit, or cap, on overall carbon emissions in the state and requires businesses to obtain allowances equal to their covered greenhouse gas emissions. These allowances can be obtained through quarterly auctions hosted by Ecology, or bought and sold on a secondary market (just like stocks and bonds).

The cap will be reduced over time to ensure Washington achieves its 2030, 2040, and 2050 emissions-reduction commitments, which means we'll issue fewer emissions allowances each year.

The cap-and-invest program is pretty complex and has a lot of moving parts. Below, we've answered some of the most common questions we receive about how this program works. If you don't see the answer you need, you can always reach out to us directly using the contact information at the bottom of the page.

Roughly 75% of statewide emissions will be covered under this program. Generally, businesses are covered under the program if they generate covered emissions that exceed 25,000 metric tons of CO2 equivalent per year.

Covered business types include (but are not limited to) fuel suppliers, natural gas and electric utilities, waste-to-energy facilities (starting in 2027), and railroads (starting in 2031).

Landfills were removed from the program after the passage of HB 1663, which establishes a landfill-specific methane-reduction program.

Are any emissions exempt?In general, businesses with emissions below the 25,000 metric ton threshold are not covered by the cap-and-invest program. In addition, some types of fuel emissions are exempt under the law – meaning that businesses do not need to purchase allowances to cover those emissons, reducing their compliance costs. Of course, all exemptions are subject to documentation and verification.

Exempted emissions include those from fuels used for agricultural purposes, aviation fuels, and marine fuels combusted outside of Washington. Emissions from fuels exported out of Washington are also excluded.

Specific guidance about exemptions are available on the CCA Emissions Reporting webpage.

How does cap-and-invest get businesses to cut emissions?Cap-and-invest is a market based program — as allowances become more scarce, they become more valuable due to the powers of supply and demand. Businesses that do not sufficiently reduce their emissions will be faced with increasing compliance costs, so investing in cleaner operations is good for the planet and the bottom line.

What happens if a covered business doesn't comply with the program?If a covered businesses chooses not to comply with the program, the CCA directs Ecology to issue steep fines of up to $50,000 per violation, per day.

Cap-and-invest auctions are sealed-bid auctions — not like the classic highest-bidder-take-all auctions we see in the movies. Instead, participants can choose to submit a single bid for all their desired allowances, or a series of bids for groups of allowances at different prices.

The bids are then automatically sorted in order of bid price, starting with the highest bid, and allocated to each bidder in that order. Once all the allowances are accounted for, the lowest bid that successfully won allowances is the price that all bidders pay.

Participants who bid below that threshold will need to purchase their allowances from other businesses and individuals on the trading market, like buying stocks.

How do I know when an auction will take place?As required by regulation, we issue a public notice of each scheduled auction at least 60 days before the auction date. These notices are posted on the CCA Auctions and Market webpage in the Auction Notices tab at the bottom of the page.

You can also sign up to receive auction alerts or general CCA updates to stay informed about upcoming auctions.

How do I participate in the auctions or trading market?Businesses and individuals who want to participate in the cap-and-invest auctions — or buy and sell allowances and offset credits on the trading market — must first register with Ecology and provide information about their corporate structure and affiliations to make sure the marketplace is fair, safe, and transparent.

You can learn more about the auction and trading registration requirements on our CCA Auctions and Market webpage.

How are auction floor and ceiling prices determined?On Sept. 29, 2022, we adopted the final language for the Chapter 173-446 WAC rule, which includes the calculations for determining auction floor and ceiling prices for cap-and-invest auctions.

The specific floor and ceiling prices for each year will be announced on the first business day of December of the year preceding the relevant auctions. The prices for 2023 auctions were announced on Dec. 1, 2022.

Do some businesses get allowances for free?The Legislature determined that three types of businesses should be issued allowances at no cost: "emissions-intensive, trade exposed" industries (EITEs), natural gas utilities, and electric utilities.

The amount of no-cost allowances a business receives depends on the type of business and their total baseline emissions or carbon intensity, so the exact amount will vary.